|

Read about the Ukraine Supply Side Impact, Our Updated Forecast for Optics and Photonics, Building Quantum Networks, Events, New Reports, and Other Noteworthy News, Opinions and Opportunities

|

|

|

|

Part 1: Ukraine and its Limited Supply Side Impact

How do current events change our outlook for the optics and photonics industry? This is a question we addressed two years ago in this newsletter when the pandemic spread, and we have to address it again as the world faces new risks. The answer comes in two parts: the supply side and the demand side.

The pandemic sent the world into an unprecedented lockdown, disrupting supply chains that keep economies running. And yet, companies worked hard to keep factories running in Asia and elsewhere, and governments responded with economic stimulus funding that helped maintain demand. Consequently, the economic impact on our industry was limited in scope and duration.

Now, a different and immense human tragedy is playing out suddenly and visibly from Ukraine. Apart from the lives lost and families destroyed, the economic devastation to the country already at this writing is heartbreaking and staggering.

Source: Mike Baldwin, Cartoon Collections.

Some companies are dramatically affected by sanctions against Russia and other obstacles. For example, member company IPG Photonics has major production and R&D facilities in Russia, and nearly 2,000 employees there (see here and here). The U.S. aerospace company Northrop Grumman can no longer use Russian-made engines for the launch vehicle it builds for NASA to service the international space station (here).

While it's hard to fathom the extent of this global interconnectedness, the direct short-term impact of the conflict to our industry is nonetheless relatively limited. The optics and photonics industry is largely oriented between Western Europe, North America and East Asia. Russian and Ukrainian companies supply relatively little of what our industry buys for itself. And likewise, there is relatively little consumption of optics and photonics products by Russian and Ukrainian customers, compared to what other regions buy from our industry.

Higher prices and restrictions on materials, such as nickel, palladium, uranium and even oil also do not directly impact the optics and photonics manufacturers the way that they might affect, for example, battery suppliers or the transport industry. However, these materials have long-term importance to our industry, recalling similar concerns in recent years over diversifying sources of rare earth metals and other critical materials (see here and here). But there are many steps from the mine to feedstock to the final product. Optics and photonics companies have to be concerned with the entire chain, not just one part of it. (The figure shows the price of nickel over the last years, with trading stopped for several days when the price spiked.)

Nickel prices over the last 12 months. Source: Trading Economics (17 March 2022).

Talk of ongoing disruptions in international shipping are even less relevant to our industry. While much of the media attention is on ships, most optics and photonics products travel by air or land freight. Moreover, our interviews with companies over the last several months indicate that even after two years of supply chain disruptions due to the pandemic, companies are challenged not by the shipping itself, but by constraints in the workforce and manufacturing capacity.

The impact to optics and photonics companies will likely be minor compared to the larger tragedy that is playing out in Eastern Europe and in the other human conflicts around the globe. It's not just the human tragedy on the ground, but the lives affected thousands of miles away by prices for essential goods and other cascading aftershocks. For many people—perhaps even billions of people—there would be no recovery from such an economic and human tragedy.

To summarize, the short-term and supply side impact of the Ukraine crisis on the optics and photonics industry will be relatively limited. The next section discusses the longer-term demand side impact to the optics and photonics industry, which can be very different.

Top

|

|

Part 2: Revising our Forecast for Optics and Photonics

The looming long-term threat to our industry from the Ukraine conflict is that wide swings in prices in fossil fuels, grain, and other commodities could trigger a global recession. Oil importing countries may face a current accounts crisis as they struggle to pay for imports. Rising grain prices can send millions of people who live at the economic margin into poverty, such as happened in 2007-2008, setting off economic and political instability.

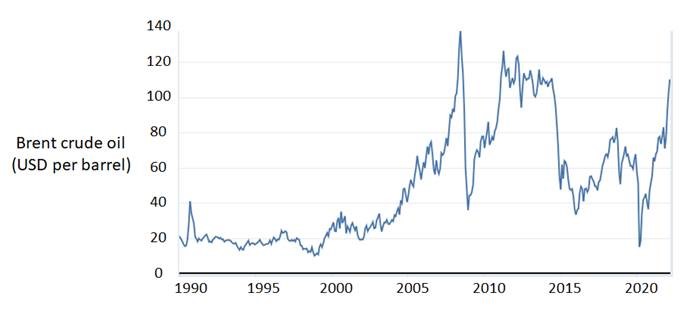

The figure below shows the price at this writing of Brent crude oil from 1990 to now. Since oil is traded on a global market, shortages in one part of the world affect prices everywhere, rich and poor countries alike. And while oil-producing countries can release more oil to the global market to attempt to reduce the price, producers cannot respond quickly. Some analysts expect the price could pass USD 200 per barrel, which would be unprecedented and sure to trigger a recession. However, at this writing, Russia continues to export oil through an exception in the sanctions, and it's not clear whether European countries are willing to cut off their own energy supply to increase pressure on Russia.

Price per barrel of Brent crude oil in USD, not adjusted for inflation. Source: U.S. Energy Information Administration (14 March 2022).

Just last month we wondered if price inflation was slowing, considering that prices of many products—such as displays, memories, and image sensors—have declined in recent months. That trend continues, as manufacturers gradually satisfy excess demand and supply chains become unsnarled.

However, the broader indexes suggest that prices are rising, quite the opposite of some volume optics and photonics products. As we noted last month, monthly consumer and producer price inflation peaked in early 2021, again in late 2021, and is currently trending up again so far this year. Those indexes are more suited for essential items and commodities, and may not reflect what happens in our lower volume and specialized industry.

Recessions hit capital equipment industries especially hard, as companies delay or cancel spending on new machine tools to conserve cash. If a recession leads to slower sales of vehicles or electronics, those industries will likely invest less in new manufacturing capacity.

And yet, most sectors in our industry seem relatively decoupled from current events. The semiconductor industry continues to announce expansions to manufacturing capacity that will cost billions of U.S. dollars (with a recent announcement from Intel for a fab in Germany). The auto industry is retooling to make new models of electric cars. Telecom and datacom operators will continue installing optical networking equipment to meet changes in traffic flows, cloud computing and 5G wireless networks. Higher energy prices make solar energy and efficient lighting more competitive. And the major military spending budgets are not likely to decline in the current circumstances.

China is an important leg to the global economy. China may be relatively less impacted by the Ukraine crisis than Ukraine's closer neighbors, but China is facing its own challenges. China's economy has slowed compared to the phenomenal pace of several years ago as it digs out from excessive debt. And now, despite its strict public health policies, it is seeing a surge in COVID-19 cases and a total lockdown in Shenzhen, even leading Apple supplier Foxconn to halt operations (here).

Source: IMF (January 2022).

Earlier this year, the International Monetary Fund forecast growth for the major economies through 2022 and 2023 (see the figure above). While China's pace may be considered high in the U.S. and Europe, it's a new low for China, with the exception of 2020. The Ukraine conflict will drive these rates lower, but it's too early to know by how much.

The following figure shows our outlook for revenues of optics and photonics systems and components. Revenues already slowed in 2019 from macroeconomic conditions at the time. When the pandemic hit in 2020, our industry did remarkably well to maintain revenues. Our industry rebounded in 2021, but current events may limit a fuller recovery in 2022.

Source: Optica (March 2022).

At this writing, Optica expects flat to modest growth of zero to 2% for the optics and photonics industry this year, from our earlier expectations of about 3-5%. This is also in part due to strong growth in 2021, which sets a higher base year for this year's growth. Stay tuned as we continue to track rapidly changing global conditions.

Top

|

|

How Do We Build Quantum Networks?

There has been a lot of talk about demonstrations of quantum computing and communication, but not as much about what's needed to manufacture the photonics for it. Yes, there are dozens of companies offering various hardware and software pieces. And customers can buy early-stage quantum computers and point-to-point quantum key distribution (QKD) systems. However, much work is needed to raise the performance and lower the cost. That is the subject of an upcoming Optica online workshop on 20-21 April 2022 (see here).

The following timeline from our Optica Quantum Photonics Roadmap illustrates how quantum communications will deploy in the coming years. Quantum random number generators and early products for QKD are available, if not widely deployed. As an alternative, post-quantum encryption is in the standardization process, although not yet commercial. Satellite-based QKD has been demonstrated, and optical communications with and between satellites is gathering interest. A wide-area quantum network is a longer-term goal, but will require quantum repeaters that are further from commercialization. (The chevrons indicate when commercialization begins, extending into the future.)

Source: Optica Quantum Photonics Roadmap, Every Photon Counts (2020).

Some in the community argue that the goal should be quantum networking, not necessarily QKD specifically. Networking could include interconnects for arrays of qubits (e.g., in a cryogenic chamber) that help scale to a useful fault-tolerant quantum computer (and discussed in a different section of the roadmap). It could also include longer-reach links between quantum computers and sensors for entirely new applications. In contrast, they note, QKD has been available for a decade but has yet to be widely adopted due to costs, its point-to-point nature and other criticisms.

The workshop will address photonic solutions in quantum networks from the top down, starting with an overview of the technology as it is today, followed by discussions from systems operators, vendors, component and material suppliers and foundries. The goal will be to identify gaps in the photonics technology and the ecosystem that will be needed to commercialize quantum communications.

For more information about the online workshop Quantum Technologies: Where are we at? see here.

Top

|

|

Thoughts From the 2022 Optica Executive Forum

Everyone was in a great mood at the Optica Executive Forum in San Diego last month. Our tireless moderators even led cheers to counter the upbeat but rambunctious group next door. It was exhilarating to be at an in-person event, seeing old friends and making new ones.

Heidi Adams and Keri Gilder at the Optica 2022 Executive Forum.

The keynote speaker, Keri Gilder, CEO of Colt Technology Services, highlighted the challenges for telecom carriers. Their profits are constrained in the consumer services business by regulators, and in the enterprise service business by competition. For example, the major markets in Europe each have four competitors, which forces commoditization of services and low margins. She said that carriers have to move beyond just connectivity to full solutions for enterprises, but the carriers don't have all the tools and will have to partner with software companies to provide those solutions. It also means a need for greater performance out of the optical networks, such as fast software defined networks, low latency, increased security against Denial of Service attacks, etc.

Contrast the situation of the carriers with that of data center operators, who have healthy profit margins from advertising and cloud services revenue. As one attendee pointed out in the Fireside Chat session, it is a free rider situation, where the operators benefit from ubiquitous cheap bandwidth, but the cost of the bandwidth is largely carried by consumers, enterprises and telecom investors rather than the data center operators. The situation reduces the telecom carriers to the role of utilities, unless the carriers can develop new, higher-value services.

Keri Gilder also highlighted the need for the industry to show leadership in inclusion. Colt has been working with Bain & Co. and the TM Forum to create the industry's first Inclusion & Diversity Score (IDS), with several companies already committed to it. The index can help benchmark company progress, understand where change is needed, and attract and retain talent. With all the calls for increasing the qualified workforce in our industry, the index is a step that companies can take themselves to improve the workforce through better diversity, equity and inclusion.

Top

|

|

Welcome Jose Pozo to the Optica Corporate Team!

On 28 February, Dr. Jose Pozo joined Optica in a new position as Chief Technology Officer. Building on 25 years in the optics and photonics industry, he will lead the growth of Optica's portfolio of corporate programs. For Optica's press release, see here.

We're excited to have Jose Pozo on board and engaging with our members!

Optica is committed to providing its corporate members with timely, market driven data to strengthen their strategic business decisions. As part of this commitment, Optica CTO, Dr. Jose Pozo, will be teaming up with LightCounting to moderate the LightCounting Industry Updates – Spring 2022 webinar. This invitation only, Optica supported webinar is open to all Optica Corporate Members and attendees of the Optica Executive Forum.

LightCounting's webinar will share highlights from MWC, OFC and GTC 2022 along with industry data from LightCounting's latest reports, including:

- Emerging Market for PAM4 and Coherent DSPs — February 2022

- Quarterly Market Update — March 2022

- High Speed Ethernet Optics — March 2022

Register Now

Top

|

|

Welcome New Optica Corporate Members

Top

|

|

Spotlight—Women in Industry

Heidi Adams, Head of Portfolio Marketing, IP and Optical Networks, Nokia

- What currently excites you most about working in the optics and photonics industry?

The optics and photonics industry is always evolving and changing. I love seeing the progression from pure research to commercialized technology and solutions. There is always something new to learn, and no excuse to ever be bored. I also appreciate how optics and photonics have been at the heart of advanced communications, playing a critical role in the evolution of networking and enabling new ways for people to connect and communicate. Without this foundation, the world would have been a very different place during the pandemic. Being able to easily connect with others through video calls for remote learning, medicine, education and work was critical. Having access to new ways to consume home-based entertainment and to stay in touch with family and friends was also priceless. We still have a lot of work to do as an industry to extend communications to all in all corners of the world, and the work being done in our industry continues to be key to helping the world to get there.

- What career advice would you give to your younger self?

Reflecting back on my career to date, there are a few thoughts I would share back to my younger self. Know your strengths, aptitudes and interests. If you are fortunate that your strengths indeed align with your interests, then always be on the lookout for opportunities where you can build and develop these skills. Leverage them to bring unique value to your team and organization. This is helping to build your personal 'brand' and sets the stage for how you can stand out from the crowd in your career. Network, talk to people, don't be afraid to ask questions. Embrace change and always be on the lookout for how you can grow. I do believe there is some truth to women often thinking they must have 110% of the job qualifications to be considered for a new role. Not so! Your strengths may well give you the foundation to take on that new challenge. Throw your hat in the ring. You may not succeed. But sometimes you will, and change while it can be scary, can also be amazing. Enjoy the journey!

- What is a hobby or passion of yours?

I have been involved in the sport of figure skating for almost my entire life - as a skater, a parent of a skater, a coach, and today, as a volunteer and official/judge for Skate Canada. What amazes me is how much growing up in a sport such as skating can help develop lifelong skills for success in your career. The discipline and patience required to learn and perfect difficult new skills, the need for consistent and diligent practice, being coachable (and learning to coach), time management, and my favorite - learning to perform under pressure. To me there is nothing scarier than competing - on the ice with all eyes watching. You learn how important training and preparation is, and that if you can manage your nerves and get this done, you can do anything. To this day, when I'm getting ready to get on stage to deliver a presentation, I still tell myself this is way easier than a skating performance!

Top

|

|

See 20 Companies Present and Network with Experts at Our Technology Showcase

Join us online 13-14 April and get an in-depth look as 20 Optica corporate member companies present and explain their cutting-edge technologies. Find new product solutions, information about the latest technology and connect with colleagues and industry experts.

The Technology Showcase is a free, 2-day program, consisting of two parts:

- 20 Showcase Presentations—Participating companies will present their latest products and technologies. This will be followed by a brief Q&A session, where you'll have an opportunity to ask your questions to the speakers directly.

- Networking—Join participating company representatives in a virtual networking space to meet face-to-face and make new connections. Networking will be available both days for the duration of the full program.

See the schedule, view the companies and register today.

Top

|

|

Quantum Technologies: Where Are We At? New Virtual Optica Workshop

Just Announced—Corporate Members Who Have Selected the Networking/Events Benefit Category Can Attend for Free!

Register now for our upcoming online workshop "Quantum technologies: Where are we at? Updates on commercial viability, scaling challenges and technical progress." Commercialization of quantum networks and technologies is rapidly evolving with greater capabilities aimed at a broadening set of applications. This workshop examines the current state-of-the-art in data center, terrestrial and satellite-assisted quantum computing and communications, identifying key applications and the role of integrated photonics.

Keynote speakers:

|

Saikat Guha

University of Arizona

The Path to Quantum Upgrading the Internet

|

Mark Wippich

MPW, LLC

Commercialization of Quantum Networking

|

Registration includes four interactive panel sessions, two keynote presentations, and four Meet the Speakers sessions. The schedule is spread over two half-days to accommodate live participation across a wider geographic range. We look forward to an engaging discussion among the panelists. And we hope the workshop will build on the Optica Quantum Photonics Roadmap: Every Photon Counts. To download the roadmap, click here.

View the schedule, see the speakers and register today.

Top

|

|

New Article: MSU Colloquium: Hot Topics in Optics & Photonics

What are the hot topics in optics and photonics, and how do you spot them? There are many ways to look at our field, and everyone looks at it differently: from investors to funding agencies and from companies in vertical markets to scientists exploring enabling technology. This presentation surveys the hot topics in our field and identifies important trends, from a talk on the topic held on 24 February 2022.

Download now.

Top

|

|

Showcase Your Company’s Useful Techniques: Submit to Applied Optics' Engineering and Laboratory Notes

Applied Optics (AO) publishes Engineering and Laboratory Notes (E&L Notes)—brief, concise articles that share useful laboratory techniques and practical engineering approaches in the applied optics field. Topics range from design and analysis, to fabrication and integration, alignment, testing, and calibration of optical systems. E&L Notes offers a unique way to publish useful techniques from your engineering notebook in Applied Optics. Read more about E&L Notes and suitable topics for submission and learn about how to submit your contribution.

Top

|

|

Invitation to Join the Optica Industry Network LinkedIn Group

Join 5,000+ of your colleagues in our Optica Industry Network LinkedIn Group. This one-of-a-kind Forum for Industry lets you participate in discussions about cutting-edge issues. Extend your professional network. Exchange information about problems, ideas and solutions. Collaborate with experts in your field. Now is the perfect time to build a relationship with fellow optics and photonics professionals!

Top

|

|

Questions or Suggestions about Optica Corporate Member Benefits?

We are committed to ensuring the value of your Optica corporate membership, so please email Optica corporate membership if you have any suggestions for new programs or comments on your membership.

Forward this message to your colleagues.

Not yet a member? Learn more about the benefits of membership.

Top

|

|

Optica Corporate Engagement Council

Thank you to the volunteers who oversee the programs and services available to the Industry Community.

|

|

Amy Eskilson

Inrad Optics, Chair

|

Simin Cai

Go!Foton, Past Chair

|

Aleksandra Boskovic

Corning Inc.

|

|

Cedric F. Lam

Google

|

Anjul Loiacono

ColdQuanta

|

Rick Plympton

Optimax Systems, Inc.

|

|

Thomas Rettich

TRUMPF

|

Natarajan ‘Subu” Subrahmanyan

AO Asset Management

|

Debbie Wilson

Lumentum

|

|

|

|

OPTICA

Global Headquarters

2010 Massachusetts Ave. NW

Washington, DC 20036

USA

|

+1 202.416.1907

optica.org

|

|

|

|

|

![]()

![]()